PTO Business Credit is here to help borrowers get the most competitive rates and terms in a timely manner on business loans, commercial loans, multifamily loans, investment property loans, and financing for business purchase or leasing of crucial equipment they require in their day-to-day business activities.

Our team of commercial loan professionals are here and ready to help you achieve your business goals. We work with hundreds of lenders locally, regionally and nationwide to ensure that our clients have access to the capital they need for business projects and achieve their goals. We provide our clients with various business loans products, capital for the purchase of commercial real estate properties and financing for the purchase or leasing of crucial equipment.

At PTO Business Credit, we understand the challenges in the business environment; we are here for you and equipped with the expertise to get you funded; it is a one stop spot for various types of loans solutions for your business. PTO Business Credit is in business to help you succeed.

At PTO Business Credit, your success is our top priority. Our team of well experienced professionals and funding partners have over 35 years of experience, thus making it possible for us to provide our esteemed clients with the crucial financial solutions they need to grow.

After receiving all required documents, approval and issuance of term sheet you can receive your capital in less than 72 hours on most loans. Our services are faster than the case of a small business loans offered by a bank.

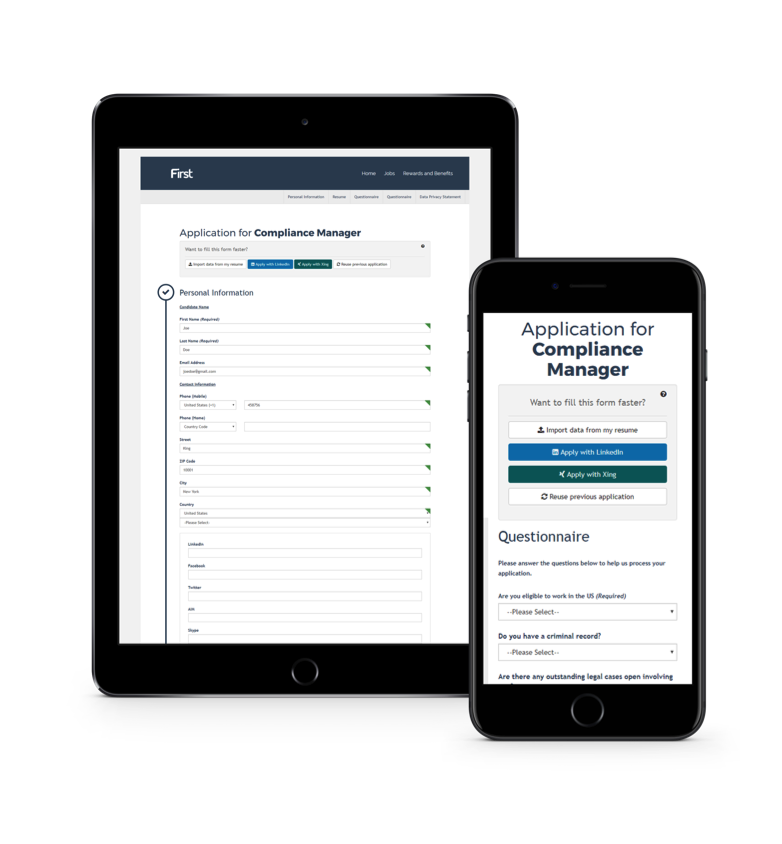

We offer straightforward and secure services. Our members sign in feature will let you get real-time updates on your application. It also allows you to know when you can come back for a start-up business loans or any other business or commercial loan.

We have been providing small business loans and commercial loans for several years now. Through the combine experiences of our loan professionals and clear understanding of the market place; we are poised to help you achieve your financial and business goals.

1. Complete our short, secure online loan form in just minutes and submit. One of our experienced loan specialists will schedule a quick call to discuss your loan details.

2. ComGather business or property documents, income and asset information for underwriting review.

3. If approved, you will be presented with your loan details, options and terms sheet. You select the best loan option.

4. Accept and execution final loan terms. PTO Business Credit begins processing your loan for closing.

5. We close business loans and fund in less than 24 hours.

6. Bridge, hard money, and rehab loans closes and funds within 2-3 weeks.

7. Conventional bank, agency, and institutional loans close in 30-45 days.

(Underwriting and appraisal deposits may be required depending upon property location and deal type.)

We help you get the best deal possible on your loans, period. By giving consumers multiple offers from several lenders in a matter of minutes, we make comparison shopping easy. And we all know-when lenders compete for your business, you win!

Whether you’re a first time homebuyer looking for a mortgage or you’re in the market for a small business loan, we’ve got you covered. PTO Business Credit is a leading online loan marketplace with one of the largest networks of lenders in the nation. Some of our products and tools include: